A transportation carrier has to be aware that each customer is unique with different volumes and freight types to ship, with specific needs and expectations. All in all, every operating decision is a factor in the expenses for a trucking company.

This article will explore in depth the types of trucking operating costs including fixed, variable, and opportunity costs.

Peak load

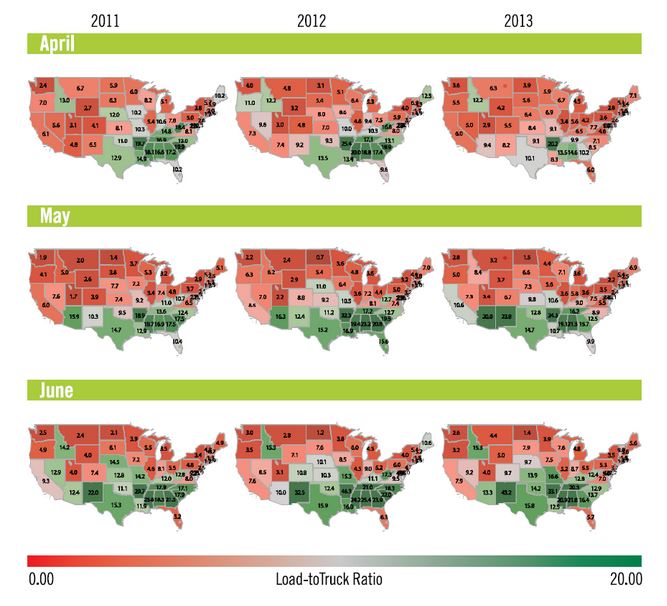

Peak load periods influence freight rates at different times of the year for different types of freight. An acceptable measure of peak load seasons is to refer to load-to-truck ratios. While there is no formal load-to-truck ratio definition, it is a market indicator that represents the number of available loads for every available truck.

The above graph indicates that the south-east region of the U.S. shows strong freight availability during the spring-summer period.

It is beneficial to account for peak load periods because they affect a trucking company cost structure. For instance, during times when peak load periods are performing in the opposite direction, the hauls conducted during this time will affect the firm’s ability to cover their fixed costs per truck.

Front haul back haul pricing

Front hauls or head hauls will be the main source of profit for a round trip whereas the backhaul can pose financial implications. Empty backhauls are not uncommon in the road transport of freight. Carriers have an option to fill an empty return trip with a load acquired from a freight broker, most commonly at a lower rate.

It is the carrier’s or owner-operator’s decision to accept the backhaul after assessing if it will make or cost them money. At times, the head haul generates sufficient revenue and there is no need for a discounted backhaul. If a backhaul is not profitable for a trucking firm, it should be taken into consideration that the operating loss can potentially cover at least the fixed costs associated with the vehicle such as insurance.

Economies of Scale

Economies of scale is the cost benefits that comes with the increased output of a product. The consumer benefits by gaining access to a lower per unit cost , and the producer has a lower operating cost due to scaled production. In other words, the production becomes more efficient as the quantity of products being produced increases. The producer can pass the savings onto the consumer because fixed costs are spread out over a larger number of goods produced. There are many ways economies of scale applies to a trucking company.

Firstly, economies of scales can be put to your company’s advantage through the utilization of a fleet fuel card. Many fuel providers offer specific cards that increase the discount on fuel prices as the volume of fuel purchases increase. Without a fleet card, the fuel provider would not be able to accurately track the volume of fuel purchased from a carrier and therefore the trucking business would not be benefiting from economies of scale.

National truckload carriers benefit from economies of scale as opposed to regional TL service providers in terms of the administrative responsibilities. A national truckload carrier will generally only dispatch a truck once in a week whereas regional truckload carriers may dispatch trucks up to 3 times per day. As a result, dealing with empty mile problems, billing, and accounting requires more staff and sophisticated operating structures for regional TL carriers.

It is needless to say there are many aspects in the trucking industry that exhaust economies of scale very quickly to the point they begin to turn the opposite direction into dis-economies of scale.

As a general consensus, it is a safer bet to work to associate economies of scale with the output of goods rather than services.

Opportunity Costs

The definition of opportunity cost is the benefit, profit, or value lost by giving up one thing for an alternative option. There are many opportunity costs trucking firms have to deal with. One such example is the dilemma between investing in more van trailers to facilitate a drop and hook operation or save money by sticking with a live loading process. The opportunity cost associated with investing in more trailers is the financial setback of buying, storing, and maintaining the equipment. The opportunity cost of not making the investment is the labor rates paid to the driver for waiting/detention time and lost revenue due to the truck being idle for longer durations during unloading/loading.

Trucking company expenses list:

Truck operating costs are generally calculated as cost per mile. There are a number expenses that factor into cost per mile such as fuel and driver wages. These cost types and others will be discussed in this section of the paper.

The fixed costs associated with operating a trucking firm are insurance, equipment payments, tolls, scales, workers compensation, legal/accounting/software fees, driver salary. The variable costs associated with operating a trucking firm are fuel, trailer fuel, fuel tax (IFTA), routine truck maintenance, third-party labor such as lumpers, travel/lodging, brokerage fees.

Fuel

The most common fuel types used by truck transportation companies in corresponding order are diesel, LNG, and CNG. This article will primarily cover diesel fuel costs. Fuel cost per mile is calculated based off miles traveled per gallon,

Truck/Trailer Equipment Lease or Financed Payments

There are many options trucking firms have when buying equipment. Owner operators can choose to lease, buy outright, finance, or obtain a truck through a carrier lease purchase program. The overall ticket price of the equipment will usually be the same for all options but costs become a factor when dealing with tax deductions, amortizations, and ownership.

Maintenance

Maintenance is considered a variable expense for the most part because it is dependent upon the usage of the vehicle. Maintenance items include oil changes and tire replacements.

Truck Insurance Premiums

Truck insurance premiums generally involve automotive liability, motor truck cargo, trailer – interchange, and non-owned trailer insurance. Trucking insurance will cost most owner-operators about $1000-$2000 per month depending on their coverage type and driving record.

Tires

Tires will generally last anywhere from 170,000 miles to 200,000 miles. After that point they need to be replaced. A standard highway tractor has 10 tires that need to be replaced each cycle with the average tire cost being around $500. Choosing the best low rolling resistance tires for a semi-truck will give you fuel cost savings of up to $2000 over the course of the tires’ lifecycle.

Tolls

Tolls are an inevitable encounter for trucking firms. The best way to reduce costs is to ensure every fleet vehicle is registered with the local toll authority so you can save on license plate processing fees.

Revenue and Cost per Mile

Calculating revenue per mile is rather simple. Multiply the charge per mile with the total miles and the result will be the revenue per mile. You will also need to factor in the fuel surcharge and accessorial revenue.

Cost per mile is an important metric that will help you determine the profit per mile and it requires tracking of all variable and fixed expenses.

Variable expenses include repairs, maintenance, tires, fuel, lodging/meals, freight broker fees, taxes. Fixed costs include truck payment, collision compensation insurance, motor truck cargo insurance, non-owned trailer insurance, health insurance, operating permits, management/legal fees such as an accountant or TMS software, and truck parking.

A rule of thumb to remember is that for every extra dollar of revenue only part of the dollar is profit but costs saved are full contributions to profit. As a result, 0.01 over a mile equates to $1200 per year given the operator is averaging a standard of 10,000 miles per month.

Once revenue and cost per mile is calculated then the profit equation is straightforward to solve:

Profit = Revenue – Costs

Understanding, these metrics will help you know what target rate you need to haul for in order to meet your costs and achieve your desired level of earnings. This article is a good basis to develop your own trucking company expense report/spreadsheet.

you are doing great

thanks

Simply wanna state that this is very helpful, Thanks for taking your time to write this.

Thanks for the reminder that I should also thinking about getting a good insurance premium when it comes to truck trailer maintenance. I’d like to know more about how I can take care of trucks because there are times when I think about starting my own tour company. I think having a fleet of truck trailers for that will give the service some novelty.