As the number of employees in an organization grow, payroll accounting fees can begin to mount. The alternative is to manage accounting functions with the best payroll software for trucking companies.

In this article, the top software for managing payroll for truck drivers will be explored.

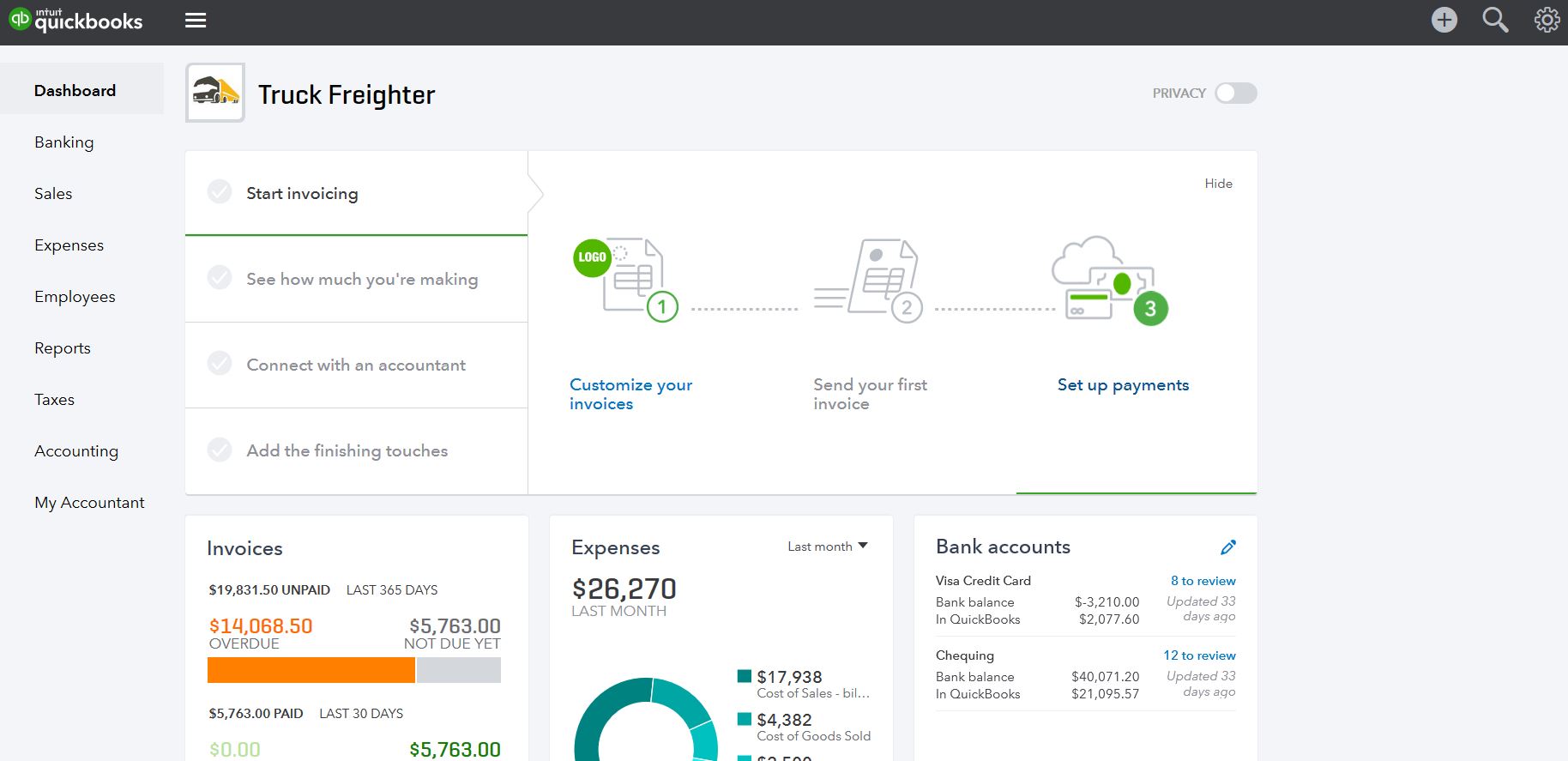

QuickBooks®

QuickBooks® by Intuit is perhaps the most popular and widely used accounting/payroll software by small-to-medium sized businesses. Most trucking businesses adhere to using QuickBooks® and therefore common software programs like DrDispatch have add-on features to integrate QuickBooks® into the overall trucking business management system. Payroll consists of ensuring employees are compensated for their work and that the proper tax filings are completed.

Review of Quickbooks for Trucking

Quickbooks for trucking is a standard software solution that allows you to manage drivers and other employees. It also enables you to track expenses and integrate your bank account statement into the program. Some of the things you can do with Quickbooks for trucking include:

- Track revenue and expenses

- Download transactions from your bank account and credit card statements and add them into the accounting system

- Print checks

- Create invoices

- Create truck driver pay stub templates

- Compare your profits and sales with industry trends

- Create a chart of accounts

- Give access to your accountant

If you wish to use QuickBooks® to pay employees given it is one of the best payroll software for trucking companies, then you do need to be an existing customer of QuickBooks® online.

If you wish to use QuickBooks® to pay employees given it is one of the best payroll software for trucking companies, then you do need to be an existing customer of QuickBooks® online.

Quickbooks payroll gives you the tools to meet compliance with all regulatory state and federal payroll requirements. You can print custom pay cheques, send direct deposits, automatically deduct taxes, print year-end forms, and store a record of employment. The standard package costs roughly $20/month as an add-on and there is a fee of $2 for each additional employee.

Truck Driver Pay Laws

There are certain rules that apply to payroll management for a trucking companies. There are many provisions that apply to payment of wages and taxes for trucking employees and each province or state has their own employment standards regulations. The employment standards legislation is the primary governing body of rules for hiring and managing truck drivers. Firstly, you are required to meet all employment standards as described in your local state’s regulations. Next you must have a payroll deductions account such as one required by the Canada Revenue Agency. Thirdly, you need to have workers compensation insurance for each employee in case that the employee is injured while on the job. A personal tax credits form should be filled out by the employee at the time of hiring. Pension and employment insurance premiums are required deductions on each pay-cheque allocated to the employee. If the employee resigns or is let go, a full record of employment must be kept at the company’s primary address of business.

Quickbooks is recommended as the best payroll system for trucking businesses because reasons such as its recognition by large banks in Canada and the United States such as the Royal Bank of Canada (RBC) and Bank of America.

I have been a owner operator under my own authority for some years now. I have purchased a second truck and need to set up payroll. Simple and easy is my goal. However, I want to be legal and accurate on the deductions for taxes and such. Direct deposit for my driver is needed. Please advise.

Ron