Introduction:

Truck drivers get paid in a variety of ways. There are various compensation models such as per mile, per hour, and flat rates per delivery. Many factors influence the type of wage and in what way that wage is paid to a truck driver. For example, short-haul and long-haul truck drivers are paid differently and the deductions/benefits they are subject to also vary. This report will discuss the various factors influencing how truck drivers get paid and provide reasoning for the different compensation models

Compensation models

Most long-haul truck drivers are paid by the mile as opposed to per hour. This is primarily due to a performance guarantee so that there is no discrepancy between the carrier and truck operator. The current market rates for over the road drivers for per-mile compensation have been adjusted to match the median hourly wage. To simplify, a 600-mile trip which takes on average 12 hours to complete is compensated at $0.50/mile or $25 per hour. However, if the driver is very skilled and can complete his/her trip in 11 hours 15 minutes his/her compensation is equal to $26.67/hr. As a result, driver incentive is higher with a pay per mile structure because it increases the utilization of the operator’s driving skills. Furthermore, if the 550 miles of the 600-mile trip are completed with an average travel speed of 53MPH in a 65MPH zone, it would take about 10 hours 25 minutes to cover the distance. The remaining 50 miles driven at 35MPH which are allocated for inner-city travel take 1 hour 25 minutes to cover the distance. In total, the trip took 11 hours 50 minutes to complete. However, if the driver is to increase his/her highway speed from 53MPH to 59MPH it takes 9 hours 20 minutes to cover the distance. Even by reducing inner-city speed to 29MPH the total trip time would only be 11 hours. This 50-minute spread creates an hourly wage difference of close to $2/hour ($25 vs $27)! Therefore, the per mile compensation model is used to promote driver performance and output.

While the per mile pay structure has prevailed in the preceding times, the advent of Electronic Logging Devices has paved a new road for the possibility of hourly pay to become more common within the industry. Electronic logs allow more accurate tracking of driver behavior and eliminate much of the uncertainty that drivers could be “passing time” when they would have been incentivized to cover more distance had they been paid by the mile as opposed to by the hour.

Practical Miles

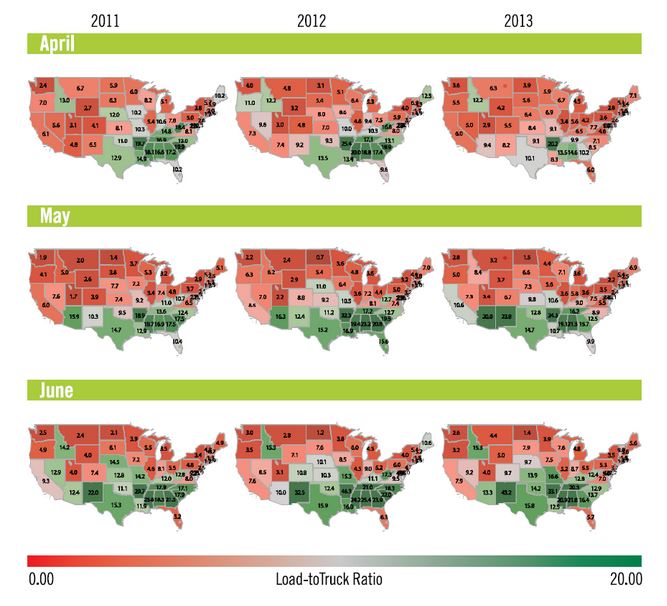

There are several route mileage structures such as hub miles, household goods miles, and practical miles. Mileage calculating methods also impact how truck drivers get paid. Some shippers and even carriers pay household goods/short route miles that only count the distance between city borders or from zip code to zip code. Also, short-route mileage counts only the most direct route and does not consider the ‘practicality’ of the route. For example, whereas traveling through the center of a city is the most direct route, its practical alternative is to take the highway that follows the city’s perimeter. Even though the direct route is 10 miles lesser than the practical route, the practical route is more efficient because it avoids congestion that may cause unnecessary delays in the delivery time.

Deductions and Benefits

Truck drivers are entitled to the legally required benefits by federal and state/provincial laws. For example, workers compensation and pension contributions are benefits truck drivers are entitled to through their carrier. Where there are benefits, there are also deductions. Some common deductions truck drivers are required to have deducted include income tax and unemployment insurance. Furthermore, if the truck driver signs an agreement to have additional deductions authorized from his/her pay then the employer may subtract those amounts from payroll payments. For example, written consent for money to be withheld to cover for the cost of training is a permitted deduction in most jurisdictions. Blanket authorizations are not valid for them to be considered as voluntary written consent by the employee. Some jurisdictions also allow for payroll deductions to reimburse the employer for any tools they may have supplied to the employee. There are specific requirements pertaining to this deduction and is best to check with your individual state along with the federal rules. For example, it is uncommon for an employer to be allowed to deduct monies from an employee’s wages for tools that are required by law such as tire chains.

Overtime Wages

Overtime wages are not mandated for over the road truck drivers engaged in interstate transportation of goods within the United States. However, unlike the U.S., Canada does have a federal requirement for the payment of overtime wages for long-haul truck drivers once they have completed 60 hours of work within the week. Hours of service rules only allow for 70 on-duty hours in a week for long-haul truck drivers. As a result, over-the-road truckers are entitled to 10 hours of overtime compensation at a rate of 1.5X their regular wage given they have completed 60 hours of on-duty within the week.

Conclusion

The above-mentioned information provides an overview of the question: How do truck drivers get paid? For further information on labor statistics regarding the truck driving profession, visit the respective websites of Employment and Social Development Canada (ESDC) and the United States Department of Labor.